Creative challenge

Merger mantras

Even as Chinese companies are looking increasingly to large advertising firms for overseas support, large holding companies like Publicis have made huge efforts to increase their presence in the Chinese market by acquiring domestic ad agencies, which have the local know-how and connections to make the transition smoother.

Over the past five months, Publicis has purchased three major Chinese advertising companies UBS in February, King Harvests and Luminous in March and Longtuo in May. The purchases are part of the company's long-term strategy to double its China presence by 2015.

Though the Publicis move is viewed by some industry experts as a late attempt to expand into China's promising ad market - many of its competitors have been present in China since the late 1980s - the recent flurry of acquisitions by the French firm indicates the crucial significance of the China market for the global advertising industry amid slow growth in Europe.

Despite several attempts to contact it regarding its recent acquisitions, Publicis did not respond.

|

||||

WPP, currently the largest foreign advertising agency in China with annual revenues of $1.3 billion, has acquired majority stakes in more than a dozen Asian advertisers during the past eight years.

"The reasons for increased interest, whenever it actually occurred, is the dawning realization that China is the second-largest advertising market in the world and growing at twice the rate of Chinese GDP growth," says Martin Sorrell, chief executive of WPP.

"China will surpass the US in terms of GDP eventually and it will be back to the future in the sense that some 200 years ago China and India accounted for 40 percent of world GDP, and they will do so again in a few years from now.

"Some believe the last couple of hundred years have been a blip in Chinese history and the country will return to supremacy, as before. I would agree."

Ancient roots

While China may be a future source of fuel for global advertising revenue, the practice is nothing new.

There is evidence that advertising has been around in China since the Song Dynasty (960-1279), when basic inked paper messages would offer services such as acupuncture treatments. But China's real foray into the world of modern advertising began during the late 1970s when economic reforms began transforming the way goods were bought and sold.

But even then advertisements were basic, touting single line messages in a style that resembled the official posters that were so common in cities and villages throughout China during that era.

Throughout much of the early 1980s, the presence of foreign advertisers was minimal. Those that took the risk to become pioneers were required by law to partner with Chinese firms.

Hidden potential

Despite the stringent industry regulations, some of the bigger foreign advertising agencies were more than convinced about the early potential in the land of more than 1.3 billion.

Often hailed as the godfather of modern advertising in China, T.B. Song, chairman of Ogilvy & Mather Greater China and chairman of WPP Greater China, the world's largest advertising company, was among the first to establish a modern advertising practice when he helped launch a joint venture with Ogilvy & Mather and Shanghai Advertising Agency in 1991.

Despite the opening of the advertising industry in the 1980s, it was not until the 1990s that both businesses and consumers began to see any form of promotions in any form of media, he says.

"All the agencies were government owned," Song says, describing the advertising landscape when he first began working in Shanghai.

"At that time, advertising was very simple. It was just about brand awareness and direct. I've seen that gradually change."

Perhaps the biggest change for foreign ad firms looking to expand in China came seven years ago, after a policy shift allowed outside agencies to establish wholly owned foreign enterprises in 2005. Prior to that, foreign firms were required to partner with domestic companies when entering the China market.

The importance of the advertising industry in China is more than emphasized in the nation's 12th Five-Year-Plan (2011-15), which has laid out plans to develop the industry that currently accounts for over 1 percent of China's GDP. The new focus is an important component of China's blueprint for moving on to a modern service-based economy.

Despite the robust growth rates and a promising future, there are still several challenges for both foreign and domestic advertising firms.

With television making up 77 percent of the advertising market share, according to a report released by Chinese market research company CTR, restrictions on media have created a barrier for foreign advertising firms operating without a Chinese partner seeking to engage in the largest portion of the market.

"This is the biggest challenge facing foreign firms," says Wang Guoji, a professor of advertising at Peking University's School of Journalism and Communication.

Twin advantages

In addition to the restrictions on media, different business practices, language and cultural barriers also present hurdles in an industry whose sole foundations are centered on communication.

It is for this reason that many of the largest companies find pairing with a local agency crucial when attempting to expand operations to work with local clients.

With a better grasp of how local businesses operate, individuals familiar with China's advertising practices can often lend an advantage when working with multinational firms.

"They are able to respond to and reassure the local business leaders who often lack global vision. This is something that is difficult to have within a multinational agency, not even in the highest tier of multinational companies," Doctoroff says.

"Even then, the relationship management is always a challenge for multinational agencies."

But, while there are many advantages to pairing with local clients, it is also crucial for companies to maintain the standard of business practices that allowed many of the multinational firms to become the global successes they have.

"You never want to fully integrate. What you're looking for, in my opinion, in an ideal world, is a cultural compatibility, an overall common view of what brands are and what brands should aspire to," Doctoroff says.

"Once you have that, these differences should be glorified."

While the benefits of pairing with local talent are clear, a thriving market and expansion of business operations across the board has made finding that talent somewhat difficult.

|

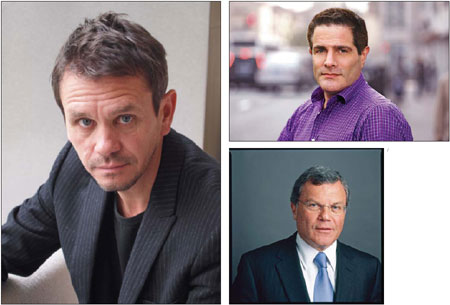

Clockwise from far left: Dave Hunt, general manager of AKQA China; Tom Doctoroff, CEO of JWT Greater China; Martin Sorrell, CEO of WPP Worldwide. Photos Provided to China Daily |

Today's Top News

- World Games dazzles audiences in Chengdu

- Choirs send message of amity at games' opening

- Foreign trade stays on stable growth track

- 'China shopping' boom spurred by favorable policies helps drive growth: China Daily editorial

- New tariff threat to ensure the chips fall to US: China Daily editorial

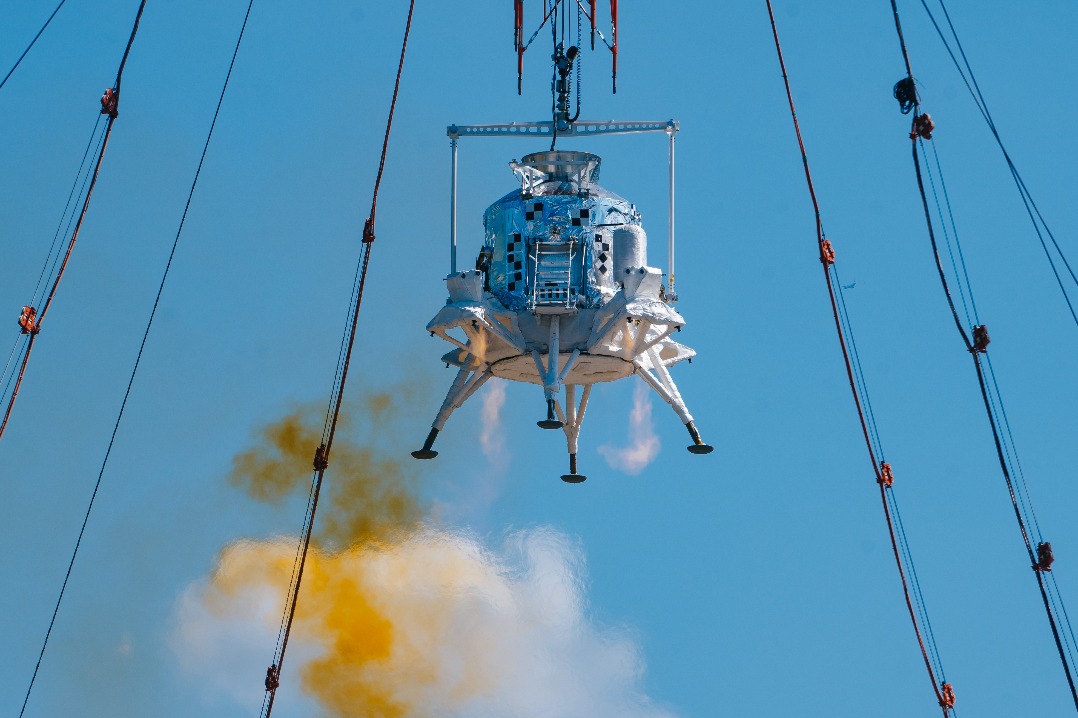

- China completes first landing, takeoff test of manned lunar lander