Starting at the top

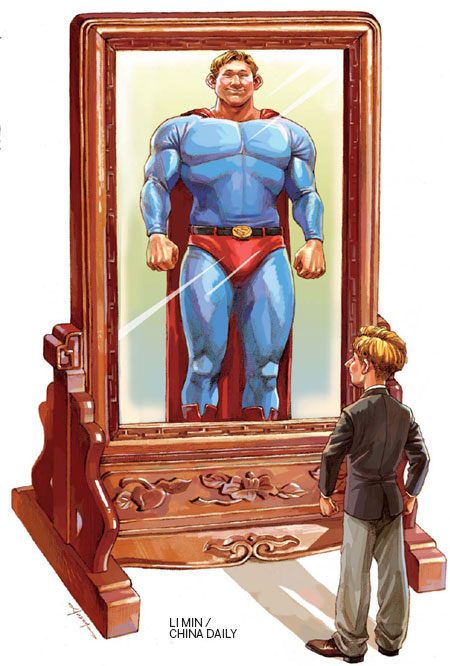

Foreign companies in China typically position their brands higher than back home. Does the strategy work?

When Harry Tan bought the Asia-Pacific management rights for Days Inn in 2003, the US-based hotel chain was hardly known in China, save for a token budget hotel that had limited occupancy and a 2.5 stars rating.

Nine years later, the hotel chain is bursting at the seams in China with more than 100 properties in various cities and regions, 30 of them having come up in 2011, and still more in the works. Operating under various names like Days Inn, Days Hotel or Days Hotel and Suites, and providing a wide range of amenities, the chain is no longer synonymous with budget hotels, but rather represents higher-end comfort.

Tan says the makeover was necessary to succeed in China as the changing economic conditions had brought about a sea change in the perceptions of Chinese consumers.

"When people move up the economic ladder, they often aspire for high-value products and services. For Chinese people, the foreign brands were always the symbols of high-end luxury and quality," Tan says.

Realizing that the challenge before him was formidable, Tan decided that the chain needed a major re-branding in China, one that would propel it into the upper echelons with ratings of four stars and above, unlike the three-star budget hotel rating it enjoyed in the US.

Like Days Inn, other global brands have also encountered similar problems in China. Though the market challenges were varied, the underlying motive was always the need to cater to the Chinese consumer with products of higher value and better brand positioning.

Such opportunities abound in many sectors like hotels, food and beverages, textiles and automobiles. Though positioned as a street-corner cafe in the US and Europe, Starbucks is perceived as a high-end meeting place in China. Similarly, the mass market and affordable furniture provider from Sweden, Ikea, is considered a fashion icon in China. Levis, the affordable jeans brand from the US, is a status symbol among Chinese youngsters. The list of products that enjoy higher social status in China is endless.

Moving up

|

Customers at a store of popular Swedish home furnishing company Ikea. Provided to China Daily |

"It is normal to position a Western brand a little bit higher in China, as 'foreign' stands for good quality in people's stereotype," says Tan, chairman and chief executive of Days Inn China.

"The higher positioning gives us more flexibility in the hotel industry. When the economy is good, those who usually stay in three-star hotels will reward themselves by moving up to four-stars. But if the market goes down, five-star people will also come to us."

Tan says that when he made the decision to move up the ladder, there were several other motivating factors. "I realized that if I continued to position Days Inn as a budget hotel, it would be harder and harder to do business in China. Property prices were also soaring, along with higher labor and utility costs. If we remained as a budget hotel, we would have to keep our prices low, thereby leaving hardly any room for profits."

|

||||

Preston says that while it is normal for people who are getting wealthy to have higher aspirations, they also need to back it up with good market research.

Chinese consumers are not at all savvy when it comes to the branding strategies of the Western brands, says Preston, adding that they often get carried away by the name.

"When the brand drops to the next tier down, a lot of people cannot really tell their status unless they go online and do thorough research. But unfortunately, they are not doing the research yet," Preston says.

Jeff Gong, director of Beijing Vogue Glamour Brand Marketing Inc, a brand consultancy, says many foreign brands have taken advantage of this mindset among Chinese consumers. Gong's agency has helped introduce many European brands, especially clothing majors, to set up shop in China.

"There are several stages in consumer behavior like following, self-experiencing and cultural identity," Gong says. "Due to the lack of information on luxury goods and the relatively late development of the consumer market, Chinese customers are still in the 'following' stage," he says.

Gong says that the best example of the blind trend can be found in the Chinese obsession for luxury products sporting big logos. "Most of the affluent people tend to buy what looks good and expensive, especially in the case of imported products."

While positioning for higher sales numbers is the most common strategy adopted by companies, in some instances the higher re-branding is necessary for companies to make up for the higher market entry costs.

"I don't think they do it intentionally, but the Chinese market is the most fragmented in the world. With such a big size and population, marketing in China is like marketing in the whole of Europe, and one has to take into account the different preferences across different regions."

In addition, running a national advertisement campaign can also be prohibitively expensive, he says.

Preston says it is possible for most of the foreign brands to go in for the higher positioning, as there are still a lot of misconceptions among Chinese consumers.

"It is also more of a cultural thing. In India and Brazil, customers don't buy the product to show off their wealth. But in China, using expensive products is considered a status symbol.

"There are lots of opportunities for foreign companies to further upgrade their image in China. With more than 500 million Chinese people still living in villages, it will take decades for many of them to urbanize and accept the new concepts."

But that does not mean that the road ahead is a smooth one. There are potholes ahead, Preston says, adding that "competition will be fierce as more second-tier brands are now moving to China".

Today's Top News

- Experts share ideas on advancing human rights

- Japan PM's remarks on Taiwan send severely wrong signal

- Key steps to boost RMB's intl standing highlighted

- Sustained fight against corruption urged

- Xi calls for promotion of spirit of volunteerism

- Xi calls for promoting volunteer spirit to serve national rejuvenation