For auto dealer, sun rises in the west

| An outlet of China Grand Auto in Urumqi, Xinjiang Uygur autonomous region. Provided to China Daily |

As car sales slow in many parts of China, it's only open roads ahead for some sellers

Most auto dealers in China have been having a rough time over the past 18 months since the government took steps to rein in the number of vehicles cluttering the country's highways and byways, but China Grand Auto, which has the highest revenue of any auto dealership in the country, has continued to make big inroads, thanks to its sales in central and western China.

Last year the group sold more than 410,000 cars nationwide, more than 90 percent of those in central and western areas, including Xinjiang Uygur autonomous region, Guizhou and Sichuan provinces and Chongqing municipality.

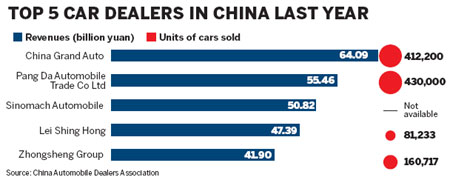

According to figures from China Automobile Dealers Association, China Grand Auto surpassed Pang Da Automobile Trade Co and became the largest auto dealership last year, with revenue of 64 billion yuan ($10.05 billion, 8.19 billion euros).

China Grand Auto is a relative newcomer to the market, being 6 years old, but its genesis goes back a lot further to 1989, when its parent company Xinjiang Guanghui Industry Investment Group was founded in Urumqi, capital of Xinjiang.

Over its short life, China Grand Auto has expanded into a network of 400 outlets in about 20 regions of China, selling more than 40 mid-range to high-end car models. About 90 percent of these outlets are located in central and western China.

In the popular imagination, western China is an underdeveloped region compared with eastern and coastal areas, and guided by such thinking only mid- to low-range cars would have a market there. But Wang Zhen, CEO of China Grand Auto, says the company has destroyed that myth by successfully going for the mid-range to high-end market in that region.

Wang worked in General Electric China for 13 years before joining China Grand Auto in 2008.

"Many people imagine western cities would be rife with low-end cars, but everywhere you look in Urumqi there are expensive SUVs," he says.

But even if the popular conception about western markets is misguided, they may well bear certain idiosyncrasies.

Luo Lei, deputy secretary-general of the China Automobile Dealers Association, says the western markets lag behind their east coast counterparts.

"The traits of the western market are those that the eastern market displayed five years ago," he says.

What makes the western auto market stand out, he says, is that it has gone into top gear, and now there is even talk of cities such as Chengdu catching up with big cities such as Beijing, Shanghai and Guangzhou. Indeed, Chengdu now has the country's fourth most influential annual auto show.

Thanks to China Grand Auto's focus on the fledgling market in the central and western China, its revenue grew 30 percent last year, just as growth was falling significantly in the east, particularly in first- and second-tier cities.

In both 2009 and 2010 the Chinese auto market enjoyed double-digit growth, and in 2010 it replaced the United States as the world's largest auto market. But for the past 18 months or so the market has cooled after government subsidies for minivans and low-emission cars were axed. Last year growth was literally decimated, falling from 30 percent the previous year to a meager 3 percent.

But those figures disguise the fact that car dealers in western China have been having a much better time of it. Since 2009 the number of cars owned in Urumqi has doubled to more than 400,000, with 500 cars now sold in the city every day.

"In many western cities there is a lack of public transport - for example, there is no subway system in Urumqi, and buses stop running after midnight, so there is a big market for cars," Wang says.

That business logic makes all the more sense when you consider that Urumqi is located in the country's far west, where daylight can stretch until about 10:30 pm in summer, and the city is still humming after midnight.

Wang says it is fortunate China Grand Auto's parent company is in Xinjiang. Its location guided the early decision to have a market strategy focusing on the west.

"As the next round of the go-west campaign continues apace, I believe the auto market in this region will keep on growing," Wang says.

At the end of last year the Ministry of Commerce introduced a guideline for auto dealers during the 12th Five-Year Plan (2011-15), aimed at fostering 30 regional auto distributors with annual revenue of 10 billion yuan, and three to five with annual revenue of 100 billion yuan.

The 64 billion yuan in revenue that China Grand Auto snared last year puts it in that league.

Although it has been able to avoid the pain that its eastern counterparts are suffering, it is well aware of how fickle the market can be and is branching out into other auto services to reduce the risks of relying solely on selling cars.

Wang says: "In 2009 and 2010 when customers were lining up to buy cars, dealers made easy money by stocking popular models and bumping up prices, but there is little profit to be squeezed from the tight market now, so we have to earn money from services."

The dealers association says after-market services, including repairs and insurance, can be three times more profitable than selling cars, but in China this sector is just finding its feet.

But it is important that these new services continue to focus on the west and on the middle to high-end market, Wang says.

He Liming, president of the association, says the service sector will be the next growth point for auto dealers.

Revenue from auto services has grown 27 percent in the past three years, he says, and is expected to be 490 billion yuan this year.

Last year China Grand Auto's revenue from after-market service grew 49 percent, the company says.

While that figure is impressive, Wang says there is still scope for improvement.

Apart from refining its service over the next five years, China Grand Auto has begun to develop new services, such as leasing, and there is talk of a used-car business.

"If you are going to have leasing services, you really need a tight, well-organized network," Wang says. "Now we have more than 400 outlets, the highest of all auto dealers in China, which is a big advantage."

"We have built a good reputation and trust with local customers, so it should be easier for us to introduce a new service," he says, adding that so far 28,000 cars have been leased to individual and corporate customers.

"In the next five years we want to build China Grand Auto into the top auto service brand."

wangchao@chinadaily.com.cn

(China Daily 07/13/2012 page18)

Today's Top News

- Xi calls for promoting volunteer spirit to serve national rejuvenation

- Xi chairs CPC meeting to review report on central discipline inspection

- Reunification will only make Taiwan better

- Outline of Xi's thought on strengthening military published

- Targeted action plan to unleash consumption momentum

- Separatist plans of Lai slammed