Mixed factors in formula for success

| The demand for baby infant formulas from foreign brands is expected to grow rapidly amid a baby boom in China. Provided to China Daily |

Foreign Brands Take Advantage of the Boom and Bust in the Chinese Infant Nutrition Market

The baby boom in the Year of the Dragon, the most auspicious animal of the Chinese zodiac, has quietly but forcefully fueled competition among foreign and domestic infant nutrition brands. While parents concerned about food safety are switching to buying infant formula at specialty stores, foreign brands are expanding their distribution channels in the Chinese market.

Zhong Wei, a mother of a 13-month-old girl, is a frequent visitor to baby specialty store Leyou in Shenyang, Liaoning province. She used to ask friends to bring back infant milk powder from abroad because of the high quality.

"But it was quite a lot of trouble and only happened occasionally," she says.

"Here at the baby store I get more professional advice and guidance. I can talk with other mothers about their parenting experience."

She also considers the mainly foreign sources of the stores' products to be more reliable following food safety scares in China in recent years, particularly after a melamine-contaminated milk powder scandal in 2008.

The scandal, in which melamine was found in raw milk from Sanlu Group, led to the death of six babies. About 300,000 children fell ill.

Zhong is one of many Chinese parents who have changed their habit of buying baby products from traditional outlets, such as supermarkets and department stores, to new ones, such as specialty and online stores.

Hu Chao, founder of Leyou, says she has noticed a change in marketing strategy by many infant nutrition brands, such as Abbott, Pfizer and Dumex, in switching focus to new distribution channels. Many have established new departments to deal with business through these routes, she says.

Athena Wang, a spokeswoman for Dumex, part of the food multinational Groupe Danone, says that they had formed a new team in China to work on distribution through mother and baby shops as well as e-commerce sites. Sources at Nestle SA, the Swiss food giant that owns infant nutrition brand Pfizer, and at US infant formula maker Mead Johnson Nutrition Co also confirmed they were following similar strategies.

A report by research company Nielsen said that infant product sales through traditional channels saw single-digit growth annually in the past few years, while those of the baby specialty stores grew by 25 percent in 2010 and 13 percent in 2011 year-on-year. More than half of the baby stores are franchise chains, according to Nielsen.

The report said the number of specialty stores in 285 cities across China jumped to 14,033 in 2011 from 11,658 the previous year.

With the demand for infant formula expected to increase because of the baby boom in the Year of the Dragon, specialty stores will be able to expand their role as a major sales channel.

"Now, traditional supermarkets and the new channels are just like left hand and right hand in terms of retailing sections. This is actually not decided by us. We just go where our consumers go," says a marketing department spokesman at Mead Johnson.

During the Year of the Dragon, the number of births is predicted to rise by 5 percent from the previous year, according to a report by Xinhua News Agency. In Shanghai alone, the number of "dragon babies" is estimated to be 180,000, the report said.

Some sociologists have said this so-called fourth baby boom is expected to last until 2015. Previous ones occurred between 1953 and 1957, in the early 1970s and in 1986.

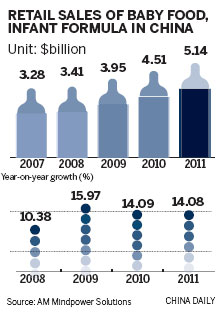

According to a report by AM Mindpower Solutions, a market research company based in India, China is already the second-largest baby food and infant formula market in the world and the largest in Asia. Consumer spending on baby food accounted for 0.12 percent of the country's GDP last year, up from 0.10 percent the previous year.

Sales in infant formula grew by 14.08 percent last year, while the growth rate was 14.09 percent in 2010 and nearly 16 percent in 2009, the report said.

Looking forward, China's overall infant nutrition sales are expected to rise this year by 21.6 percent to 75.5 billion yuan ($11.9 billion, 9.4 billion euros), according to market research company Euromonitor International.

But while the market has been growing, domestic infant formula makers have seen demand continue to fall since the drastic drop in retail sales as a result of the contaminated milk powder scandal in 2008-10.

Today millions of tins of infant formula, mainly imported from New Zealand and Europe, are being sold to Chinese parents through increasingly popular online shops for mother and baby items, such as Tmall, Redbaby and also baby specialty stores.

Foreign products account for more than 70 percent of sales at such stores, says Kiki Fan, vice-president of Nielsen China Retail Measurement Services.

Hu of Leyou says most of the infant formulas on sale at baby stores now are foreign brands.

"At first, we had domestic milk powder in our shops, but the sales were far from satisfactory. It has been proved that our consumers prefer international brands because of food safety considerations since 2008."

Leyou has seen its chain of stores expand from seven in 2007 to 210 today, scattered throughout 10 cities, including the relatively small one of Langfang in North China's Hebei province.

"We don't necessarily go for the first-tier cities, but we've found our buyers are mostly high-end and mid-end customers, even in the smaller cities. We did not choose our customers. They chose us," Hu says.

In high-end infant formula market, foreign brands account for 85 percent of sales, according to a report by CIC industry research center, a Shenzhen-based consulting company.

The increasing demand in China for international infant nutrition brands has also meant an increase in the price of baby formula at an average rate of 15.5 percent each year for the past six years, although the price of raw materials for production has been falling, according to a People's Daily report.

The CIC's survey concludes that the foreign infant nutrition companies enjoy on average more than a 50-percent gross profit margin in China.

"But the one-child policy has made Chinese parents tolerant about the price rises, as they cannot afford any potential health threats for their children," says Annie Bian, a consultant at Ipsos Research in Shanghai.

In spite of the current domination of international infant nutrition products, domestic brands still have opportunities, Bian says. As long as their products' quality and reputation are good, Chinese producers can take advantage of their solid penetration of supermarkets in lower-tier cities and towns.

"Some domestic brands, like Beingmate, are actually doing rather well in terms of their multiple distribution channels and quality control," Bian says.

xiaoxiangyi@chinadaily.com.cn

(China Daily 06/22/2012 page12)

Today's Top News

- Xi calls for promoting volunteer spirit to serve national rejuvenation

- Xi chairs CPC meeting to review report on central discipline inspection

- Reunification will only make Taiwan better

- Outline of Xi's thought on strengthening military published

- Targeted action plan to unleash consumption momentum

- Separatist plans of Lai slammed