IN BRIEF

|

|

Property

Shui On Land plans IPO for Xintiandi Unit

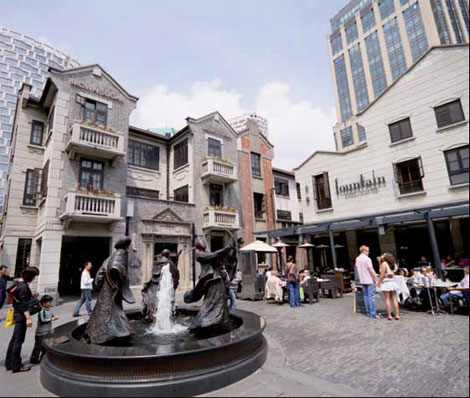

Shui On Land Ltd, the Shanghai developer controlled by billionaire Vincent Lo, plans to sell shares in its Xintiandi entertainment complex unit to investors in a separate listing in Hong Kong.

The Shanghai-based company has submitted the proposal to the Hong Kong stock exchange, Shui On said in a statement. The company did not say how much it plans to raise and when the listing, which is subject to the stock exchange's approval, will be completed.

The company's first Xintiandi project is a residential and commercial complex in Shanghai built through the redevelopment of houses dating back to the 19th and 20th centuries.

Power

State Grid to buy Brazil assets

State Grid Corp of China said it has agreed to buy electricity transmission assets in Brazil from Spain's Actividades de Construccion y Servicios SA for $531 million and assume debt of $411 million, the latest in a series of overseas acquisitions by Chinese power companies.

State Grid Corp's wholly-owned subsidiary State Grid International Development Ltd will take over seven high-voltage electricity transmission assets in Brazil from ACS, the State-owned power firm said in a statement via Bank of America Merrill Lynch, which acted as exclusive financial advisor to State Grid on the deal.

Finance

JPMorgan beefs up China operations

JP Morgan Chase & Co has injected 2.5 billion yuan ($393.8 million, 316.1 million euros) into its China unit, the latest foreign bank to beef up its Chinese operations.

The additional capital will better position the bank in the evolving regulatory environment and cement its commitment to clients in China, said Zili Shao, chairman and chief executive of JP Morgan China.

The capital will be used to expand the bank's branch network, develop products, increase corporate lending and recruit employees, Shao added. The injection brings the registered capital of the locally incorporated unit to 6.5 billion yuan.

Currency deal ushers in a new era

China and Japan have started direct trading of their currencies since June 1 in a move to boost trade ties between Asia's two biggest economies.

This is the first time that China has allowed a major currency, apart from the US dollar, to trade directly with the yuan.

Direct trading of the currencies means that the two countries will not be using the dollar as an intermediary in setting exchange rates.

Yuan-yen trading are processed on the Tokyo and Shanghai markets, and the daily yen-yuan central parity rate is formulated by the weighted average of prices given by market makers, said the China Foreign Exchange Trade System, the central bank's trading arm.

Markets

Crude futures to be launched this year

The Shanghai Futures Exchange aims to launch the nation's first crude futures by the end of the year, said Wang Lihua, chairwoman of the exchange.

The exchange will allow foreign investors to trade the contracts, as part of the nation's move to make its commodity futures market more accessible to foreign capital, Wang said.

By opening up the market for foreign investors, the exchange aims to become a price-setter for oil in Asia and a global marketplace for crude futures, she added.

Auto

Energy company eyes Swedish carmaker

A group led by a Chinese energy company and a Japanese venture-capital firm has made a bid for the bankrupt Swedish carmaker Saab Automobile, a spokesman for the investment team said.

The two main parties in the group are Sun Investment, a Japanese firm that specializes in undertaking high-tech environmental projects, and National Modern Energy Holdings Ltd, which has roots in Hong Kong and builds and owns power plants that use renewable sources of energy, Mattias Bergman, a spokesman for the group in Sweden, said.

BMW to expand production capacity

Bayerische Motoren Werke AG, the world's biggest maker of luxury cars, will quadruple its production capacity in China, preparing for rising demand in the world's largest auto market.

The capacity at a new plant in the Tiexi district of Shenyang will rise to 200,000 vehicles in 2014, adding to the 100,000 cars that BMW now produces at a factory in the city's Dadong district, the Munich-based company said. Total China production could rise to as many as 400,000 vehicles in the future, the automaker said.

China Daily-Agencies

Today's Top News

- Xi calls for promoting volunteer spirit to serve national rejuvenation

- Xi chairs CPC meeting to review report on central discipline inspection

- Reunification will only make Taiwan better

- Outline of Xi's thought on strengthening military published

- Targeted action plan to unleash consumption momentum

- Separatist plans of Lai slammed