Marking time

|

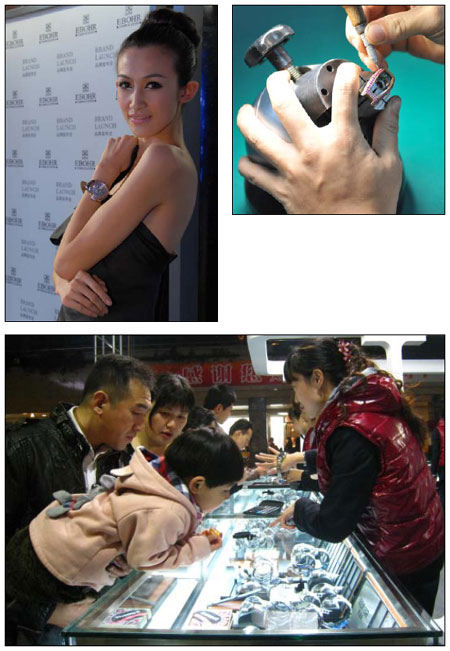

Above: An employee works on an Ebohr high-end product. Left: A model displays Ebohr's latest product. Below: Customers select watches at a department store in Shenzhen. More than 150 watch companies in Shenzhen have established their own brands. [Photos Provided to China Daily] |

In addition, the company has hired master designers from Switzerland since 2009 who not only design watches but give Ebohr's Chinese staff intensive training.

"Even Ebohr's counter and merchandise display in department stores are designed by our European professionals," Tao says, adding that it wants to provide customers not only with a quality watch, but with a more internationalized shopping experience.

In June 2010 Ebohr launched a series of luxury watches in Switzerland under the brand Ebohr Complicated, which is a new sub-brand that targets high-end consumers in the West. Tao says EC proudly proclaims its 100 percent Chinese pedigree, and its price ranges from 410 euros ($520) to 2,500 euros.

"The sluggish economy is making more rich people in Europe shift their attention from expensive European-made luxury watches to well-crafted watches of affordable prices from China," Tao says.

"We hope this new watch brand will gradually promote a China high-end manufacturing concept first in Europe and then spread to the whole world."

As more international watch brands covet the vast Chinese market, watchmakers in Shenzhen are also facing the mounting pressure of winning over more consumers in the domestic market, especially in the mid-range to high-end segment.

"We have to cultivate our own consumer groups by enhancing our brand recognition," says Sha Hengyi, president of Shenzhen Geya Watches.

Sha says Swiss timepieces have an edge in their brand heritage, but Shenzhen watchmakers enjoy the advantage of having an abundant supply and broad distribution channels and, most important of all, they understand Chinese consumers better.

Geya, founded in 1993, and whose sales had been patchy at best, began to ramp up its brand-building efforts in 2007. That image-building strategy has boosted sales revenue from less than 50 million yuan in 2006 to more than 600 million yuan in 2011, and it maintains a robust annual growth rate of more than 50 percent.

"An increasingly well-known brand can pull up the added value of our products and help us expand our market presence," Sha says.

Geya watches can now be found in more than 1,600 department stores in China, covering almost all major and second- and third-tier cities, he says.

In addition to branding, Geya has also increased its research and development efforts.

"Our designer is required to abandon imitation; each design must be original and in line with our own style," Sha says.

Last July Geya acquired Phinex, a time-honored Swiss watch brand, and Sha says the acquisition will enable Geya to learn more advanced watchmaking techniques from Swiss counterparts.

But Sha worries that heavy reliance on imported watch mechanisms might be the biggest constraint in the development of Shenzhen's watch industry, because although the China-made tourbillon mechanism is no worse than those imported from Switzerland and Japan, current technology and facilities cannot mass produce it.

"Without the backing of watch mechanisms made in China the development of Shenzhen's watch industry will face a lethal bottleneck in the future," Sha says.

To remove the technical obstacles that hinder the development of Shenzhen's watch industry, the Shenzhen government has greatly boosted its policy and financial support.

It set up a watch industrial park covering 1.2 square kilometers in Guangming New District last March, and 12 key local watch enterprises and research and development institutions are now there. It also signed 10 cooperation contracts worth 980 million yuan with Swiss watch companies last year.

The park will have an important role in creating a technology-sharing platform for Shenzhen's watchmakers and will serve as a research and development center and professional training base, says Zhao Caixia, director of the trade and industry section of Shenzhen Guangming New District.

"The Swiss watch industry went through the same problems we have today, but it overcame those problems, and its watch industry is vibrant today," Zhao says.

She says Shenzhen should learn from Switzerland's experience to accelerate technological breakthrough by tightening cooperation with international watchmakers.

Despite the difficulties, Zhao is optimistic about the prospects of Shenzhen's watch industry.

"Relying on the vast Chinese market, we are confident we can turn a native Shenzhen watch brand into a real international watch brand, but it takes time and effort."

Today's Top News

- Xi calls for promoting volunteer spirit to serve national rejuvenation

- Xi chairs CPC meeting to review report on central discipline inspection

- Reunification will only make Taiwan better

- Outline of Xi's thought on strengthening military published

- Targeted action plan to unleash consumption momentum

- Separatist plans of Lai slammed